Fluctuation of Prices in the Steel Industry

None can deny the steel industry is in crisis and has been for more than a year. Britain alone has seen the loss of 2,200 jobs last October when Redcar was closed by its Thailand based owners. This was swiftly followed by an announcement from India’s Tata Steel of plans to sell its UK steel business after cutting 3,000 jobs in separate culls since last summer. Furthermore, Caparo Industries also cut 452 jobs and put a total of 1,700 jobs at risk last October after going into administration.

Back in the glorious heyday of 1994, the UK steel industry employed up to 37,000 staff. By 2014 that figure was down to 18,000 and is now further reduced to only 13,000. Admittedly, increased productivity has accounted for some of that reduction but more direct causal factors are the fluctuating steel costs, international competition (particularly from China), and the UK government’s expensive environmental policies.

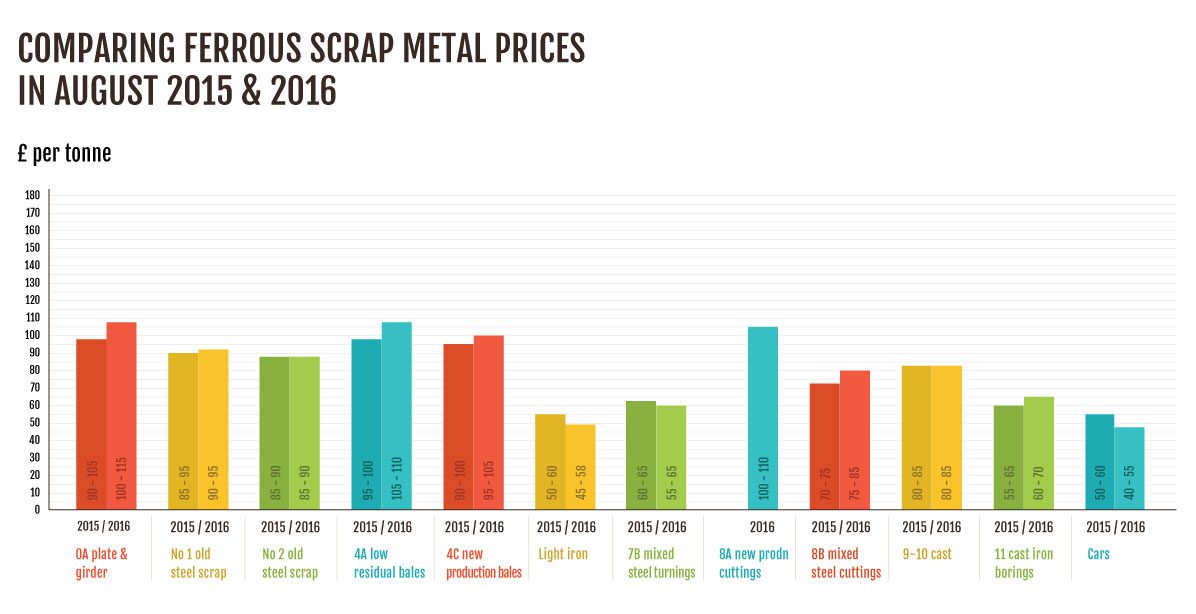

The below graph shows ferrous scrap metal prices in August 2015 and 2016:

Fluctuating Steel Prices

The recession and financial crisis from 2008 hit the steel industry hard and it has not recovered since. Worldwide demand for steel has reduced and continues to fluctuate or grow only sluggishly.

Effectively, the global price of steel has dramatically declined. China has also faced a steep economic deterioration leading to a reduced national demand for steel as their manufacturing industries slow down.

Consequently, Chinese steel producers have been looking to the export market to fill the void. As a result, the British steel industry has not only met increased competition and challenge for price cuts in its own export market, but many British manufacturers have actually been lured by lower costs to import steel from China while ignoring their own, more expensive national steel industry.

Chinese steel exports have increased from 66.4 million tonnes in 1990 to 822.7 million tonnes in 2014, mostly driven by increased domestic demand for steel due to their incredible economic growth.

Today, steel production outweighs demand by almost 20% and critics say that steel is sold internationally at a loss making their prices impossible for other countries to compete. Furthermore, prices in Europe are also unbeatably low leaving the UK with limited export opportunities dashed even further by the then strong pound against the euro following the global recession.

The fall in value of the pound following the Brexit outcome may well have a more positive impact on British potential to export steel to Europe, but at present that remains to be seen. World steel prices dropped from $592 US dollars per tonne in February 2015 to only $453 by the end of the year and have since risen only very slowly reaching $520 by April 2016.

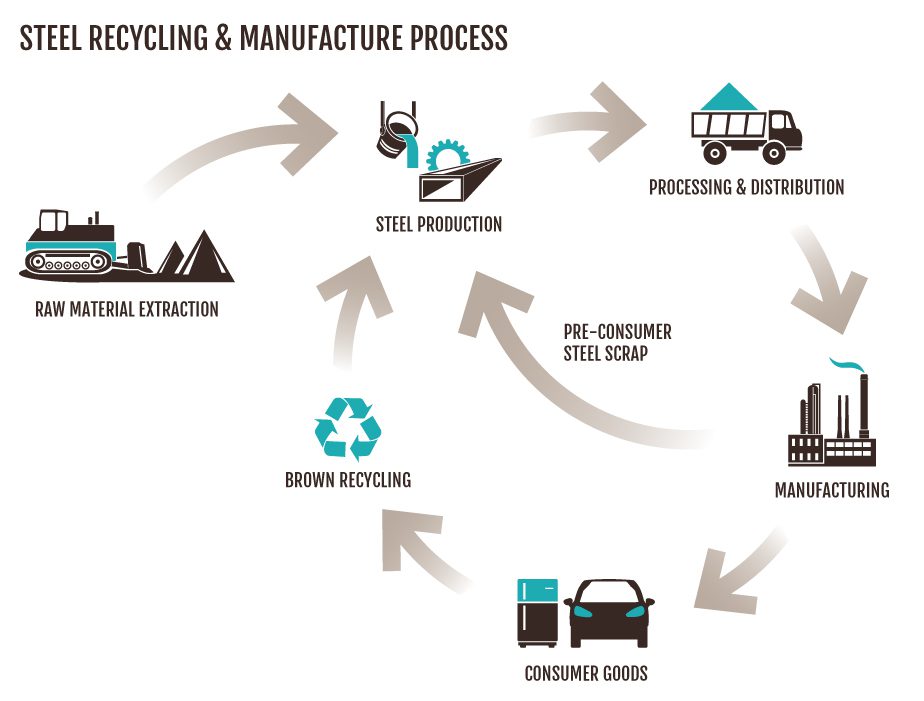

This useful graphic shows you the life cycle of steel and metal sourcing and processing:

UK Legislation

The cost of raw materials has an obvious effect on the cost of steel and, as one of the main components of new steel, scrap metal has a fundamental impact on those costs. The availability of scrap metal is volatile.

In addition, the 2013 Scrap Metal Dealers Act has led to a tightening on licences awarded to professional dealers to develop a professional register and greater supervision in order to reduce metal theft and clamp down on rogue traders. This is heartening for the steel industry in some respects as it was reported that metal thefts fell by over 30% from 2013/14. However, green policies have added what some see as unnecessary costs to the production of steel which further hampers the ability of the British steel industry to match prices of international competitors.

Impact of Brexit on the steel industry

The initial drop in value of the pound might have made UK steel more attractive to the European import market and lead to an increase in export. Furthermore, potential purchasers of Tata Steel might also be lured by what could be seen as an increase in value for money.

Fundamentally, the Brexit could have a positive impact on the UK steel industry if it allows the UK government to bail out the steel manufacturers as they did the banking sector during the recession.

EU laws made it illegal for our government to support an ailing industry but if those laws are removed, or loosened, if could pave the way for remedial action to save our once booming steel industry from complete destruction. However, with the impact of Brexit still not fully revealed in all sectors, the true effect on the steel industry remains to be seen.

This website uses cookies to enhance your browsing experience and deliver personalised ads. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyse site usage, and assist in our marketing efforts.